Best Audemars Piguet Watches for Investment in the USA (2025)

Luxury watches have become a prime investment option, and Audemars Piguet (AP) stands out among the best brands for long-term value. Known for exclusivity and exceptional craftsmanship, AP watches are highly sought after by American collectors. Below, we explore the top Audemars Piguet models ideal for investment in 2025, especially for the U.S. market.

1. Royal Oak Jumbo Extra-Thin (Ref. 16202ST)

The Royal Oak Jumbo is iconic and consistently performs well in secondary markets in the USA. This 39mm stainless steel watch with an extra-thin profile retains high value due to its timeless design and limited production. Its simplicity and heritage make it a favorite among American investors【8†source】【10†source】.

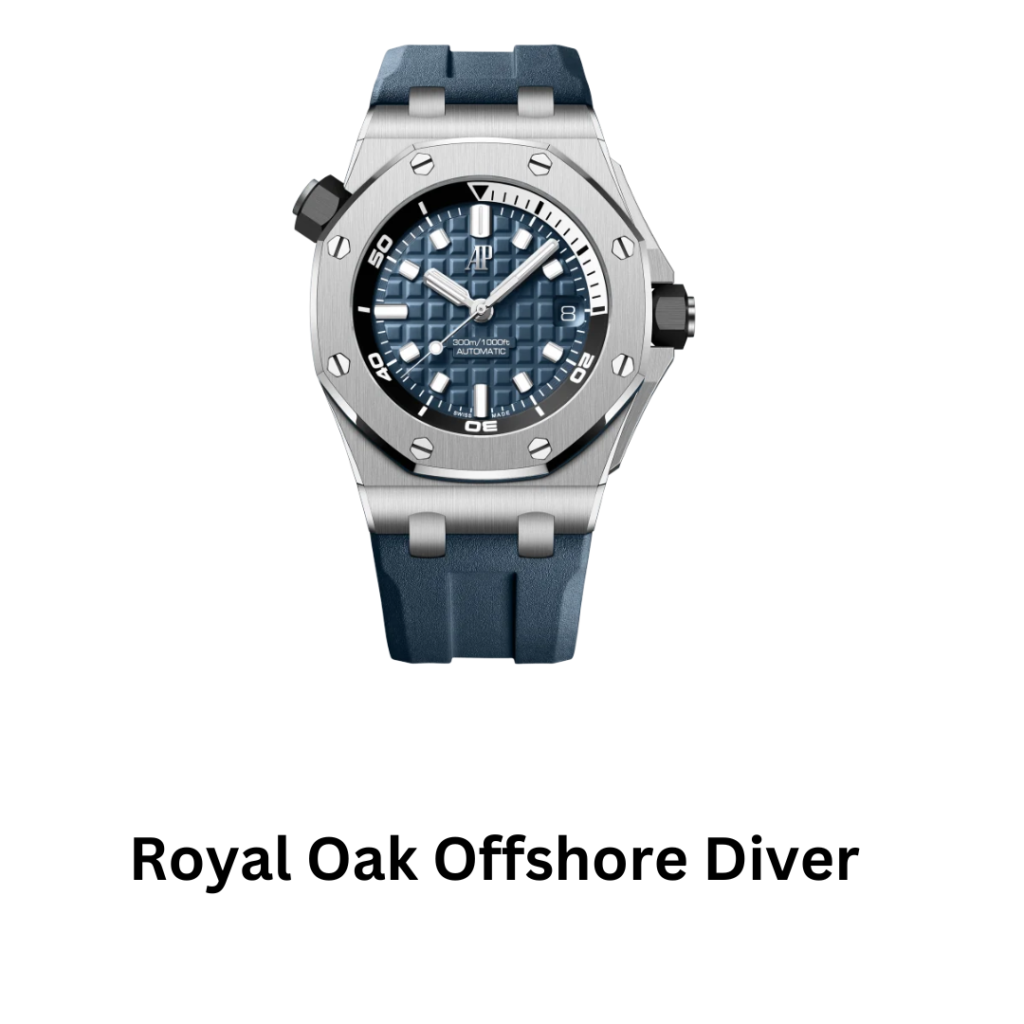

2. Royal Oak Offshore Diver

For a sporty option, the Royal Oak Offshore Diver is a top choice in the U.S. market. With robust water resistance and a bold design, it caters to both enthusiasts and collectors. Its versatility makes it highly desirable, particularly limited editions which have strong appreciation potential【9†source】.

3. Code 11.59 Chronograph

Audemars Piguet’s Code 11.59 collection has gained popularity in the United States for its innovative design and unique aesthetics. The chronograph versions, especially in precious metals, are excellent for investment. As the collection matures, it’s becoming a more recognized and valued piece in American watch circles【10†source】.

4. Royal Oak Perpetual Calendar (Blue Dial)

The Royal Oak Perpetual Calendar in stainless steel or rose gold is a U.S. collector’s dream. Its intricate complications, such as the moon phase and perpetual calendar, paired with a stunning blue dial, make it highly attractive. This model has shown steady appreciation due to its mechanical ingenuity and rarity【9†source】【10†source】.

Why Audemars Piguet is a Smart Investment for Americans

- Heritage and Craftsmanship: Established in 1875, AP’s commitment to handmade watches appeals to collectors seeking authentic Swiss craftsmanship.

- Limited Supply: AP produces a limited number of watches annually, ensuring exclusivity.

- Resale Value: Audemars Piguet watches consistently rank high in resale value, with the U.S. being a strong market for pre-owned luxury watches.

- Cultural Relevance: AP has strong ties with U.S. celebrities and athletes, boosting its brand value stateside.

Tips for Investing in Audemars Piguet Watches in the USA

- Buy Limited Editions: Rare models, especially those launched at U.S.-focused events, tend to appreciate in value.

- Use Trusted Dealers: Purchase from AP boutiques or trusted American dealers for authenticity and proper documentation.

- Follow U.S. Auction Trends: Sotheby’s and Christie’s often feature AP watches, offering insights into their market value in the U.S.

By investing in Audemars Piguet in 2025, Americans can enjoy the dual benefit of owning a luxury item and a growing asset. From the legendary Royal Oak to the bold Offshore series, these timepieces are more than just watches—they’re timeless investments.

In the competitive U.S. luxury watch market, Audemars Piguet (AP) has carved out a unique niche as both a status symbol and a solid investment option. Its ability to combine exquisite craftsmanship with limited production makes it a favorite among American collectors and investors. The iconic Royal Oak Jumbo Extra-Thin, for example, appeals to those seeking timeless designs with a proven track record of value appreciation. Meanwhile, the sporty and robust Royal Oak Offshore Diver caters to modern tastes, blending utility with style, making it a great fit for active American lifestyles. The futuristic Code 11.59 Chronograph, with its blend of tradition and innovation, is capturing the interest of younger U.S. investors looking for distinctive timepieces. Additionally, the Royal Oak Perpetual Calendar continues to shine as an investment gem, boasting both mechanical complexity and aesthetic appeal. Each model underscores AP’s commitment to exclusivity and quality, qualities that resonate strongly with the discerning American market. Whether you’re a seasoned collector or new to luxury watches, Audemars Piguet offers pieces that can enhance your portfolio and reflect your refined taste. By making thoughtful choices, U.S. investors can turn these luxury items into profitable assets, securing both financial and personal satisfaction.